There are several forms of health insurance, and you can agree on an insurance package with

an understanding of each of them. Community, patient, Medicare and Medicaid insurance are

the most popular forms of insurance.

Group Health Insurance

The health insurance group is supported by an employer, agency or union. The arrangement

between the employer and an insurance firm that operates group arrangements makes this

possible. The group insurance policy offers a group of people which typically allows for a

discount. Employers who cover companies pay usually a part or all of the premiums. Employees

shall pay the remaining premium and the premium due will generally be taken off the top of their

salary check per pay period.

Employers can select between a variety of plans, including management and benefits, or only

one form of plan can be provided. Many community programs also provide incentives for dental

and vision.

Group plans provided by unions, clubs and associations are comparable to company plans by

encouraging the party to obtain a discount. However, they vary since each person pays his or

her own premiums absolutely

Both employers and workers may benefit from group programs. As a tax expenditure, employers

can say premiums charged. The discount and/or reimbursement for some of the premiums is

given to workers which results in very inexpensive health benefits. Such plans will also have

more money coverage than most individual plans.

Individual Insurance

You will subtract your health insurance premiums from your federal taxable income if you work

as a self-employed individual. This helps reduce the pressure a little and allows you as a

company owner to get decent health insurance. You may also subtract insurance premiums for

the whole family. See how this plays for your accountant.

You should buy individual insurance if the company does not have medical coverage. You may

pick the business you want to run and the type of package that best fits your needs with

individual insurance. To find the best package for you, you can buy around and compare prices,

benefits, deductibles and payment plans. Unfortunately, the whole premium is expected to be

charged and community discounts are not given.

Indemnity or Managed Care Plans

If you have a group plan or an individual policy, these two forms of policies also give you

options. You can choose between insurance and treatment plans. In some ways they are

similar, but in others they are very different. Both plans provide a broad variety of facilities

including medical, hospital and surgical facilities. Many of these plans provide some form of

limited dental and/or vision coverage for prescription drug coverage.

You can select a physician for medical treatment with health benefits and even change

physicians if you wish. This form of plan may allow you to pay a deduction. You could also face

higher out-of-pocket costs. With managed care, the option of some network providers, known as

network providers, will save you money. For any office visit you will have a co-pay rate like $10

or $20. Prescription medicine is graded as type and non-form, with lower cost forms protected

by the insurance. The health maintenance organization (HMO), the preferred provider (PPO)

and point-of-service (POS) plans are three types of management health care plans.

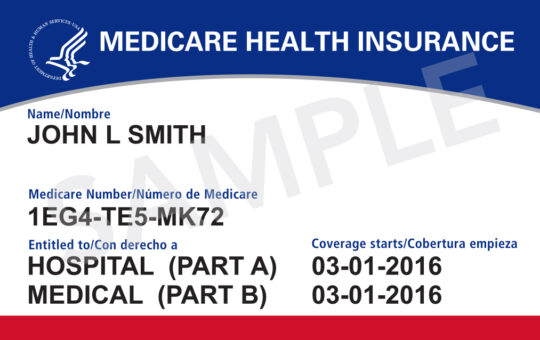

Insurance for Medicare

Medicare Insurance is a scheme given to elderly people 65 years of age by the federal

government. Medicare coverage may also be available to eligible persons with a disability or

end-stage renal disease (ESRD). Medicare is composed of four parts: Part A, Part B, Part C and

Part D. Section B is physicians ‘and other associated providers’ medical insurance. Part C or

Medicare Advantage is a program which provides individuals with a private health plan for the

benefit of Part A, B and D. Section D is a medical treatment prescription.

Part A needs no premium because payroll taxes have been charged in the years of a worker.

Part B asks for a monthly income premium. Part D still requires a premium, but if you are not

enrolled as soon as you apply for Medicare, this premium is higher. For those with Medicare

Medigap provides private insurance to aid with paying costs not covered by Medicare.

Insurance for Medicaid

A federal-state system provides for Medicaid benefits that each state has its own rules on

covered costs and eligibility. For those with small incomes, pregnant women and their newborn

children and blind or disabled people, medicaids are available. Children may also be protected

by certain circumstances, even if the parent is not exempt. You should review the criteria with

your Medicaid office.

Such insurance types vary in many respects and cover a range of persons and situations. They

are distinct. Study every form carefully to see what works for you.

Life & Disablity Insurance for Employees

by admin

Why Long-Term Care Insurance should be part of your portfolio

by admin

The Basics of Medicare

by admin